This material is not a recommendation to buy, sell, hold or roll over any assets, adopt an investment strategy, retain a specific investment manager or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition, or particular needs of any specific person. Investors should discuss their specific situation with their financial professional.

The “S&P 500” is a product of S&P Dow Jones Indices LLC (“SPDJI”) and has been licensed for use by Nationwide Life Insurance Company (“Nationwide”). Standard & Poor’s®, S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); DJIA®, The Dow®, Dow Jones® and Dow Jones Industrial Average® are trademarks of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Nationwide. The Nationwide Indexed Principal Protection℠ group fixed indexed annuity is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P or their respective affiliates, and none of such parties makes any representation regarding the advisability of investing in such product(s), nor do they have any liability for any errors, omissions or interruptions of the S&P 500.

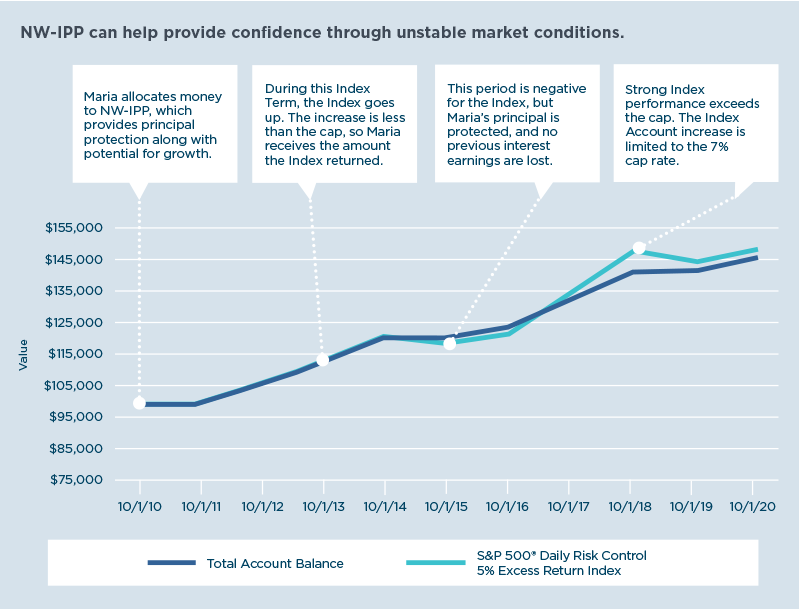

Group fixed indexed annuities are not stock market investments and do not directly participate in any stock or equity investments. The index does not include dividends paid on the underlying stocks and therefore does not reflect the total return of the underlying stocks; neither a market index nor any fixed indexed annuity is comparable to a direct investment in the equity markets. When you purchase Nationwide Indexed Principal Protection, you are not directly investing in a market index. The actual return of the index account will be based on the performance of the underlying index. It is important to understand that actual returns may be less than the return of the index due to the index cap. Past index performance is not a guarantee of future performance. Group fixed indexed annuities are contracts purchased from a life insurance company. They are designed for long-term retirement goals. Withdrawals are subject to income tax, and withdrawals before age 59½ may be subject to a 10% early withdrawal federal tax penalty. Nationwide Indexed Principal Protection is a group fixed indexed annuity issued by Nationwide Life Insurance Company and held in the general account.

Guarantees are backed by the claims-paying ability of the issuing insurance company. Transfers out of this contract to other funding providers are subject to certain restrictions. Contact your plan sponsor for information regarding these restrictions.

Nationwide, the Nationwide N and Eagle, Nationwide is on your side and Nationwide Indexed Principal Protection are service marks of Nationwide Mutual Insurance Company. © 2022 Nationwide